Inverse Head and Shoulders Pattern: A Comprehensive Guide

The most important question for a trader is: will this trend continue or reverse? If you’re riding a trend, you wouldn’t want to panic and exit when the price temporarily goes against you. And you’d want to exit fast if the trend is about to reverse. Looking at this another way, you would want to enter a trade just before a trend begins, to maximise your gains.

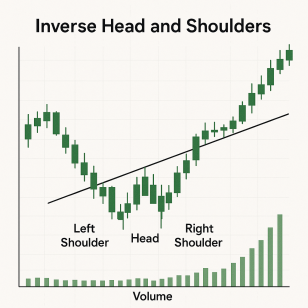

There are some chart patterns that give strong cues about the probable winner in the tug of war between buyers and sellers of an asset. The inverse head and shoulders pattern stands out as among the most popular bullish reversal signals. Here’s a simple, yet detailed guide for a chart pattern that you don’t want to miss.

What is the inverse head and shoulders pattern?

The inverse head and shoulders pattern is a bullish reversal chart pattern that forms at the end of a downtrend. It signals a potential shift in prices to an upward trajectory. It is essentially the inverted version of the classic head and shoulders pattern, which is a bearish reversal signal. Recognising this pattern can provide traders with an early indication that selling pressure is easing, and buying interest is beginning to dominate in the market.

Anatomy of the pattern

This pattern is made up of 3 troughs (lows) and 2 peaks (highs) between the troughs. Its formation suggests that the asset, which had been on a downtrend, is experiencing a shift in market sentiment. The pattern has the following components:

Left shoulder

This formation is the first phase of the pattern where the price experiences a small and temporary rebound from a downtrend. This shows that some buying interest has emerged, but it is not strong enough to reverse the overall trend. Sellers quickly respond and push the price back down.

Head

After the left shoulder is formed, the price falls to a level below the previous low of the left shoulder. This forms the head and is the lowest point of the pattern. The head is followed by a strong rally.

Right shoulder

After the rally from the head, the price declines gain to form the right shoulder. This is a very important part of the pattern, as its formation gives the most clues about the shift in market control. The low of the right shoulder must be higher than the low of the head and about the same as the low of the left shoulder. This higher low is the actual signal, where sellers are unable to push the price lower because there is too much buying interest.

The series of lower lows (left shoulder to head) followed by a higher low (right shoulder relative to the head) indicates that the bears are no longer able to push prices to new lows and buyers are stepping in to drive the price upward.

Neckline

This is important as it serves as the confirmation of the pattern's validity and the trigger for potential trades. It is drawn by connecting two highs: one between the left shoulder and the head and the other between the head and the right shoulder.

The neckline can take the following forms:

- Flat or horizontal: this is the clearest type of neckline and indicates consistent resistance at that price level.

- Upward sloping: this is more bullish than the flat neckline. It shows that buyers are pushing the price even higher every time it declines. There is increasing underlying strength even before the breakout. This kind of neckline suggests a steeper rally after breakout.

- Downward sloping: This is less bullish than the flat neckline. It suggests there is less buying power. A breakout after a downward sloping neckline may be followed by a more gradual rise in prices.

Regardless of its slope, the neckline acts as a resistance level. A break above this neckline with enough volume signals the potential for a new uptrend. Yes, volume is a very important parameter. Here’s a look.

Volume dynamics during formation

Volume is important for both identifying and confirming an inverse head and shoulders pattern. This is because volume indicates the strength or weakness of price movements.

The downturn at the beginning of the left shoulder is typically accompanied by high volume, reflecting strong selling pressure. The bounce from the left shoulder's low usually occurs on lower volume, indicating that the initial buying power is low.

The decline that forms the head usually has very high volume. This is what takes the price to the lowest point to form the head. Then comes buying action at very high volume, as well.

The decline to form the right shoulder should occur with much lower volume. This shows that sellers are giving up. As the price begins to move back towards the neckline, volume should start rising, confirming renewed buying interest.

The most crucial volume confirmation is at the breakout of the neckline. A valid breakout must be accompanied by a surge in volume. This typically confirms strong institutional money coming into the market. This provides the fuel for the upward price move to be sustained. If the breakout has low volume, it should be seen as a red flag or false signal.

Comparison with the traditional head and shoulders pattern

The two patterns are mirror images. The traditional head and shoulders pattern signals the end of buying pressure and the possibility of a price decline, the inverse head and shoulders signals the end of selling pressure and the possibility of a rally.

| Feature | Inverse head and shoulders | Traditional head and shoulders |

| Market context | Forms after a downtrend | Forms after an uptrend |

| Pattern type | Bullish reversal | Bearish reversal |

| Structure | 3 troughs (lows) | 3 peaks (highs) |

| Head position | Lowest trough | Highest peak |

| Shoulder position | Slightly higher troughs than head | Slightly lower peaks than head |

| Neckline action | Price breaks above neckline for confirmation | Price breaks below neckline for confirmation |

| Implication | Potential uptrend | Potential downtrend |

Psychology behind the pattern

The pattern shows a shift in the psychology of market participants from pessimism to optimism. It illustrates the transfer of power from sellers (bears) to buyers (bulls).

Trader sentiment from downtrend to potential uptrend

During the downtrend and left shoulder formation, the market is dominated by pessimism, fear, and/or panic. The bounce from the left shoulder shows a brief flicker of hope, but bearish sentiment quickly takes over, driving prices down again. The head formation shows the peaking of bearishness, which takes the price to the lowest point at a high volume. Traders who were riding the downturn begin closing their positions to avoid further losses. During the right shoulder formation, market psychology shifts.

The price is unable to reach the head’s low because of the surge in buying interest.

As the price rallies from the right shoulder and approaches the neckline, market sentiment is rapidly turning. Buyers confidently push prices higher. When the price finally breaks above the neckline, it triggers a surge in long positions.

How to identify the pattern on a chart

Successfully identifying the inverse head and shoulders pattern on a live chart requires a clear understanding of its structure and awareness of the market context in which it typically forms.

Ideal market conditions

For the pattern to be considered reliable, it should form under the following market conditions:

- Preceding downtrend: since the inverse head and shoulders pattern gives a reversal signal, it must appear after an established downtrend. The pattern formation during an uptrend or a sideways market invalidates it as a reversal signal. The longer and steeper the preceding downtrend, the more powerful the potential reversal signal.

- Sufficient liquidity: the asset should have ample trading volume and liquidity. The pattern forming for assets that lack liquidity are unreliable. High liquidity ensures that the price action more accurately reflects broad market sentiment.

- Moderate volatility: markets always have some volatility, but excessive price swings can lead to noisy charts and false signals.

Ideal timeframes

The pattern forming in longer timeframes, like weekly and monthly charts, show a more sustained downtrend and indicate a more reliable reversal. Traders typically use medium timeframe charts, like 4-hour and daily charts, as they offer more frequent trading opportunities. The pattern forming on lower timeframes, like 1-hour, 30-minute and 15-minute charts, are far less reliable and prone to false signals. Experienced scalpers use these charts for short-term opportunities.

It's always better to use more than one timeframe to identify the pattern, apart from confirmation from other indicators and strict risk management.

How to distinguish from double bottoms, triple bottoms, and triangles

Sometimes the inverse head and shoulders pattern is confused with other reversal or continuation patterns.

- Double bottoms: a double bottom pattern consists of 2 distinct lows that are at almost the same price level, separated by a peak. This signals a strong support area that has been tested twice. Remember, the inverse head and shoulders pattern has 3 lows, with the middle one (the head) being distinctly lower than the other 2.

- Triple bottoms: a triple bottom has 3 lows at about the same price level, indicating even stronger support than the double top. The difference from the inverse head and shoulders pattern is that the triple bottom does not have a significantly lower head in the middle and the 3 lows are roughly equal.

- Triangles: these patterns are typically consolidation patterns, formed by converging trend lines. They represent a period of indecision before a breakout in either a continuation or a reversal.

Entry and exit strategy

Identifying the inverse head and shoulders pattern is only the first step. Knowing how to enter and exit a trade is most important for traders. Here are some trading strategies to consider.

Entry on neckline breakout

This is the most common and definitive entry point. It occurs when the price closes above the neckline. A spike in the price above the neckline that fails to hold by the end of the candle's period is often a false breakout. For instance, if you’re using daily charts, wait for the daily candle to close above the neckline. Also, don’t forget to check the trading volume. Be cautious of a breakout on low volume.

Alternative entry: neckline retest confirmation

A more conservative strategy is to wait for a neckline retest confirmation. After a breakout, it's not uncommon for the price to pull back to the neckline. If the price bounces back, it means the neckline has turned into a support level. This retest validates the breakout.

While this strategy offers a lower-risk entry point, not all breakouts retest the neckline. If the price simply continues to move higher, the trader misses the initial rally.

Stop-loss placement

Stop-loss is an important part of risk management for traders. The most common stop-loss placement when using the inverse head and shoulders pattern is just below the lowest point of the right shoulder. This is because if the price falls back below the right shoulder's low, it means the pattern has been invalidated and sellers have regained control.

Traders who use the conservative entry point often set the stop-loss just below the retested neckline or below the low of the bullish bounce-off candle.

Profit target calculation (measured move)

First measure the height of the pattern or the vertical distance from the lowest point of the head to the neckline. Add this measured distance to the price level of the neckline breakout to determine your minimum profit target.

While this calculated target provides a good baseline, you’ll need to adjust the exit strategy based on market conditions, strength of resistance levels, and the behaviour of other indicators.

False breakouts and how to avoid them

False breakouts are when the price moves beyond the neckline but quickly reverses and continues to decline. This can trap traders who entered prematurely. Understanding and avoiding such false breakouts is important for preserving your capital.

Signs of a false breakout

Several red flags can indicate a false breakout:

People also watch

- Low volume: a breakout without enough volume means there are not enough buyers to sustain the upward price movement.

- Quick reversal: red candles forming after the breakout, especially if there are more than 2 candles.

- Long wicks: breakout candles with long upper wicks, as these show the presence of some selling pressure.

- Weak candlestick formation: breakout bullish candles with small bodies, as these show weak buying power.

To minimise the risk of false breakouts, it’s good to wait for the candle to close, retest the neckline, check for high volume, and confirm your inference by using technical indicators.

Best indicators to combine with the pattern

Building a confluence strategy, or combining chart patterns and technical indicators, helps validate the price action and filters out weaker signals. If you notice the inverse head and shoulders pattern, consider combining it with 1-2 of the below technical indicators.

Relative strength index (RSI): look for a bullish divergence, which is where the price hits lower lows (especially at the head and right shoulder), but the RSI makes higher lows. This divergence signals weakening selling momentum. During the breakout, an RSI moving above 50 or 60 further confirms bullish strength.

Moving average convergence divergence (MACD): a bullish MACD crossover (MACD line crossing above the signal line) around the time of the neckline breakout, acts as a confirmation of momentum. This is especially the case if the histogram turns positive. A bullish divergence on the MACD is also considered a precursor to the formation of the pattern.

Moving averages (MA): price breaking above key MAs (like 50-period or 200-period) along with the neckline breakout adds another layer of confirmation. You may use simple or exponential MAs. A ‘golden cross’, which occurs when a shorter-term MA crosses above a longer-term MA, is considered a signal of a new uptrend beginning.

Volume oscillator: this indicator can provide a clearer and smoothed representation of volume trends, which makes it easier to confirm the volume surge at the breakout.

Bollinger Bands: look for price breaking out of the upper Bollinger Band with conviction. Often, the bands will get closer during the consolidation phase of the inverse head and shoulders pattern and widen upon breakout. This is a sign of increased volatility and momentum.

Fibonacci retracement: this does not directly confirm the pattern. The Fibonacci levels can be useful for identifying potential resistance levels above the target, or for finding support if the price retests the neckline from a prior swing low.

Inverse head and shoulders pattern in different markets

While the principles of the pattern remain the same, the market dynamics of different assets plays a role in the interpretation.

Stocks

When using this pattern for trading individual stocks, it’s a good idea to keep in mind the company’s fundamentals and some key data, like earnings report, change in management, entry of new competitors and expansion into new markets. Being aware of the sector dynamics also helps.

Also, volumes tend to surge around the opening and closing bells of the stock market.

Forex

The forex market is open through the day and liquidity differs depending on which regions are trading. The highest volumes are observed when sessions overlap, particularly the London-New York overlap. These higher-volume periods are important for validating breakouts.

The most important data to watch when trading currency pairs include economic outlook, interest rate differentials, and geopolitical events.

Cryptos

The cryptocurrency market is known for its high volatility and steeper price swings. This often leads to chart patterns forming frequently, offering more trading opportunities. The downside of such volatility is that the risk of false signals is higher.

Trading volumes are even more critical for the volatile world of cryptos. Also, the currency against which a crypto is being traded impacts its volatility. Larger volumes are traded for the most popular pairs, like BTC/USD and ETH/USD. Some lesser-known cryptocurrencies may have very low volumes being traded.

Since cryptos are not backed by fundamentals, their demand is heavily influenced by news. Markets respond very quickly to positive and negative news. So, staying abreast is important for crypto traders. Remember that FOMO (fear of missing out) can cause crypto prices to quickly breach key resistance levels.

Commodities

Commodity markets, including precious metals, energy, and agricultural products, tend to exhibit longer-term trends. Pro traders tend to use daily or weekly charts to identify patterns.

Trading strategies using the pattern

Identifying the inverse head and shoulders pattern is merely the first step. You need a well-defined strategy to trade this pattern.

Neckline breakout strategy

This is a direct approach. Once the price closes above the neckline, accompanied by a surge in volume, you can enter a long position. This strategy focuses on taking advantage of the immediate momentum generated by the breakout.

- Entry: on confirmed candle close above the neckline.

- Stop-Loss: below the low of the right shoulder.

- Profit Target: measuring the height of the head to the neckline and projecting from breakout point.

Neckline retest strategy

This is a conservative approach. It involves waiting for the price to retest the broken neckline, which now acts as support.

- Entry: wait for the price to pull back to the neckline after the initial breakout and clear signs of the price bouncing off it.

- Stop-Loss: just below the retested neckline or below the low of the bounce candle.

- Profit Target: same as the breakout strategy.

Multi-timeframe analysis

This strategy involves using a higher timeframe to identify a strong preceding downtrend and identifying support levels. Then zoom into a lower timeframe to look for the formation of the pattern. Patterns formed near support levels are more reliable.

Real-World Examples

Between early February and the first week of March 2020, BTC/USD remained on a downtrend, falling from around $10,166 to about $8,000. Once bitcoin had breached the support level, buyers stepped in to form the right shoulder of the inverse head and shoulders pattern. Sellers remained determined, sending the price to $3,782. This marked the lowest point, or head, of the pattern. Buyers came in with greater force and the breakout occurred. The rally following this saw the bitcoin climbing past $10,000 on July 2.

Common mistakes to avoid

Being aware of these pitfalls is as important as knowing how to identify the pattern itself.

Premature identification: a valid pattern requires the full formation of the left shoulder, head, and right shoulder, followed by a confirmed breakout above the neckline. Entering a trade before the pattern is fully formed increases risk significantly.

Ignoring ideal market conditions: downtrend, liquidity and volatility need to be well considered. Traders who ignore these could be entering on a false signal.

Waiting for perfect symmetry: while the ideal pattern is one that is perfectly symmetrical, where the left and right shoulders are mirror images, this is rare. Traders sometimes miss out on opportunities waiting for the perfect pattern.

Drawing the neckline incorrectly: drawing the neckline to connect prices that don't represent clear resistance levels can lead to an inaccurate breakout signal.

Ignoring the relevance of timeframes: giving the same weightage to the pattern being formed on a higher or lower timeframe can lead to poor results. A pattern on a 15-minute chart has far less significance and a higher chance of failure than one on a daily chart.

Setting unrealistic targets: the thumb rule is to measure the height of the head to the neckline and project it from the breakout point. Yet, you cannot blindly follow this, without considering factors like strong resistance levels or a scheduled data release that could affect market sentiment.

Advantages and disadvantages

Like any technical analysis tool, the inverse head and shoulders pattern comes with its own pros and cons.

Advantages

- Clear risk/reward setup: the biggest benefit of this pattern is that it provides clearly defined entry, stop-loss, and profit target levels. This allows you to calculate the risk-reward ratio before entering a trade.

- Widely recognised pattern: as many traders recognise this pattern, they respond to a market where it shows up. This means many traders react similarly, which contributes to the pattern being formed. It’s like a self-fulfilling prophecy.

- Strong bullish reversal signal: when confirmed and accompanied by strong volume, the pattern can identify a major trend reversal.

- Offers multiple entry points: traders have the flexibility to choose between an aggressive breakout entry or a more conservative neckline retest entry. This means traders with different risk appetites can trade this pattern.

Disadvantages

- Can be subjective without supporting indicators: while the basic structure is simple, variations in shoulder heights, extent of neckline slope, and timing of volume spikes can introduce subjectivity. This is why it is so important to confirm your interpretation with technical indicators.

- Prone to false breakouts in volatile markets: some assets are more prone to extremely volatility, while others may experience volatility depending on the news. Events like the pandemic, war, and imposing of tariffs can result in high volatility and false signals.

- Pattern failure: no chart pattern is 100% accurate. The pattern may fail to reach its target even after a valid breakout.

- Requires patience: waiting for the full pattern to form and for volume confirmation at the breakout can make you anxious. Also, waiting can result in you missing a part of the initial price move.

The inverse head and shoulders pattern can be a powerful and reliable bullish reversal signal, provided you understand the confirmation criteria and know the mistakes to avoid.